Associative Remote Viewing for Finance and Sports Betting

One of the most common questions about remote viewing is whether we can use it to win in financial and betting markets. The answer is yes, however of course there is a “but…”.

Approaches #

We can use remote viewing to look directly at events e.g. board meetings, future sentiment of shareholders, the mood in a sports bar of a certain team after a game. This approach can work, but the tasking (where the viewers are ‘sent’) is harder to get right, and there tend to be more avenues for failure as mapping the remote viewing data onto wagerable outcomes is both more subjective and more open to unexpected problems. Perhaps there’s actually a wedding on at that sports bar, and everyone’s happy even though the team lost? Perhaps the board are feeling fine because they have no skin in the game, even if the results aren’t looking great? This kind of approach is more suited for one-off events where there’s a budget for multiple long-form remote viewing viewing sessions and detailed analysis.

In these cases, viewers would be tasked to describe some specific event, for example:

The viewer will move to the XYZ Corporation quarterly board meeting on <date> and describe the overall sentiment regarding the financial report to be released on or around <future date>.

This is great when we want nuanced data, but problematic when we want to make predictions about abstract things like sports teams or market prices. Remote viewers produce their data by translating the symbolic, feeling language of the subconscious mind into spoken or written language and drawings.

Our subconscious minds are a bit like independent beings in their own right. They experience the world differently from the conscious mind. The process of learning remote viewing involves developing a progressively closer relationship with this part of ourselves.

One significant issue which arises from this reality is that our subconscious minds easily get bored! This is one proposed explanation for the decline effect seen in forced choice psi experiments, and why the free-response nature of remote viewing avoids this effect.

Another issue is that words, numbers and arbitrary distinctions without any inherent identity are hard to discern. What does that target price of $347.20 feel like? Good question! Does it feel really different from $302.10? Probably not.

Associative Remote Viewing to the Rescue! #

If we’re trading or sports betting, we need an approach with a fast turnaround, precise targeting and low overheads. This is where Associative Remote Viewing (ARV) shines.

Associative Remote Viewing works with the nature of the subconscious mind by associating interesting but distinct targets with each one of (usually) two outcomes. Now our tasking looks more like this:

Tomorrow's soccer match between England and Spain. If England wins, describe picture A only. If Spain wins or the match is a draw, describe picture B only.

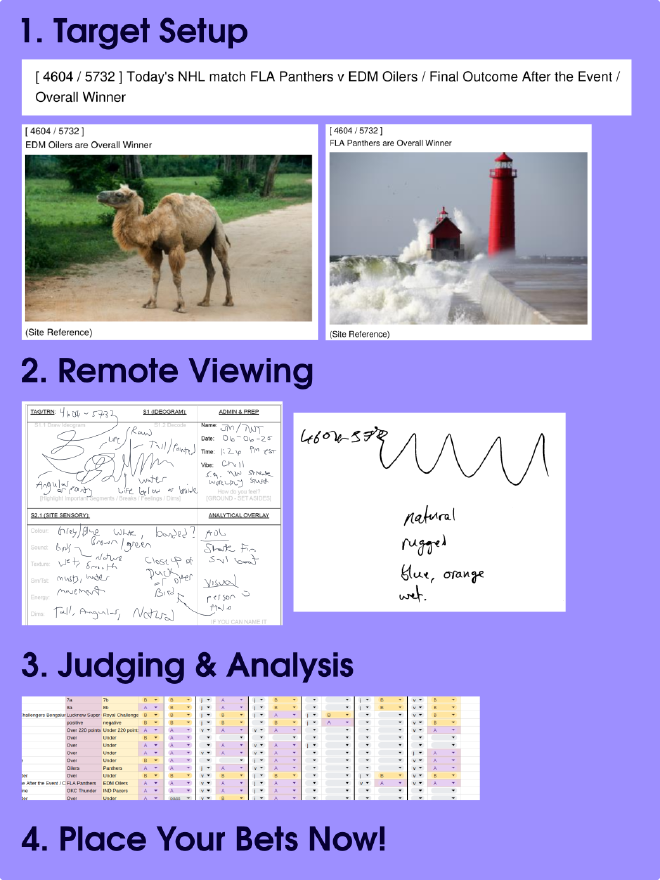

To make this clearer, here’s a real example. I recently formed a team of experienced remote viewers to predict outcomes with ARV, and this is a real example of one of our targets.

Remember that remote viewers work blind, so they were only given the target reference number and their job was to describe one of the associated targets without seeing them. Once the result is in, the viewers are then shown the image associated with the real outcome.

How Accurate is it? #

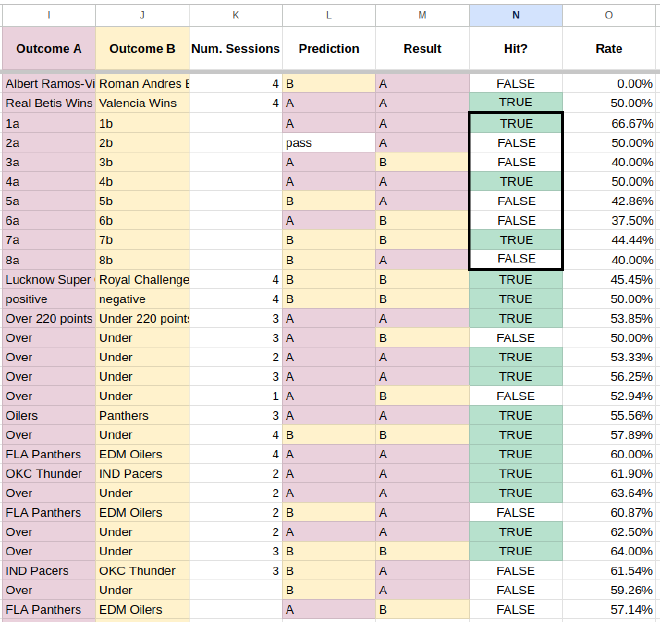

There are a lot of moving parts to ARV, including you as the end client of the prediction data. In a properly functioning team, the long term accuracy should be over 50%. I have seen performance at up to 80% in runs over several weeks however this is not sustainable in the long run. Risk management is essential, and we should plan for a 50-60% hit rate while hoping for higher. It is possible to get it higher, but we should always be planning for the worst while expecting the best, and never betting money we can’t afford to lose.

At time of writing (June 16th 2025), my team’s hit rate is sitting at 57.14%. If you ignore a particularly disastrous experiment in predicting the winner of the recent PGA tour then it’s at 65% and has been as high as 80%.

We do not, and cannot, guarantee any level of accuracy because this is an inherently delicate process and not all the factors influencing accuracy are known nor under our control. The way to start up a project safely is to start paper trading then phase in trades/bets, starting from a nominal value.

The following sports bet tasks were set internally in the team, for our own practice and profit.

If you’re a trader or gambler who already has a strategy and solid risk management then schedule a call now to discuss how we can integrate ARV into your process to improve your hit rate.

Can’t I Just Win a $100M Lotto Jackpot? #

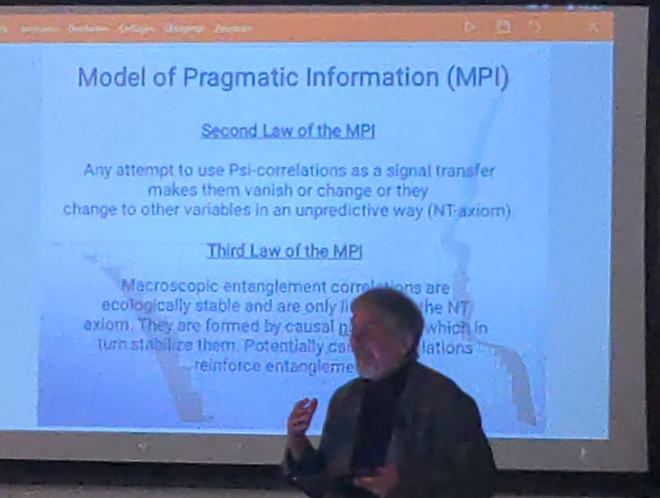

For reasons perhaps best described by Walter von Lucadou’s Model of Pragmatic Information1 - no. No we can’t. And it’s not for lack of trying!

Remote viewing - and especially remote viewing future events - depends on non-linear causality. We’re talking future-affecting-the-past, atemporal causal agents, time loops - crazy stuff that gives me a headache trying to reason about. Everyone involved in a project, and the results of the project, all become entangled with the project itself. This means that the potential real world impact of the remote viewing - and it’s compatibility with the probabilistic future - affects the data which can be collected.

We need to target future events where the real odds of success are reasonable. Of course, if the odds are 1:1 then we can’t make any money, but the more outlandish a bet, the higher the risk that remote viewing will fail. There is a sweet spot then, where we can use remote viewing to find profitable bets and trades or filter the output of an existing strategy to improve hit rate. The future is flexible, but only to a limited extent. The same properties of our reality which keep Harry Potter firmly in the realms of fiction mean that we must compound wins based on that small flexibility over time - reality will not ‘bend’ enough for us to do it in one big bang.

Or, in other words; you can’t get rich quickly with remote viewing, but you can get rich slowly.

More Information #

If you’re interested in learning more, you can check out the following episodes of The Psychic Guys. In this first one (1.07) we do a general roundup of remote viewing future prediction.

Jon Knowles felt we were overly negative about winning the lottery, so he generously agreed to join us in the next episode (1.08) for a deep dive on financial remote viewing in order to set the record straight!

Further Reading #

- Katz, D. L., Grgic, I., & Fendley, T. W. (2018). An ethnographical assessment of project Firefly: A yearlong endeavor to create wealth by predicting FOREX currency moves with Associative Remote Viewing. Journal of Scientific Exploration, 32(1), 21–54.

- Katz, D. L., Grgić, I., Tressoldi, P., & Fendley, T. (2021). Associative Remote Viewing Projects: Assessing Rater Reliability and Factors Affecting Successful Predictions. Journal of the Society for Psychical Research, 85(2).

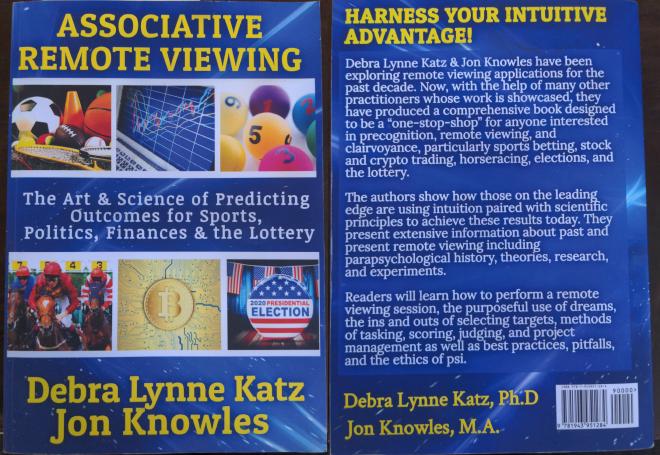

- Katz, D. L., & Knowles, J. (2021). Associative Remote Viewing: The art & science of predicting outcomes for sports, politics, finances & the lottery. Living Dreams Press.

- Kolodziejzyk, G. (2013). Greg Kolodziejzyk’s 13-year associative remote viewing experiment results. Journal of Parapsychology, 76, 349–368.

- Kruth, J. G. (2021). Associative Remote Viewing for Profit: Evaluating the Importance of the Judge and the Investment Instrument. Journal of Scientific Exploration, 35(1).

- Müller, M., & Wittmann, M. (2021). Anomalous Cognition in the Context of Time: Does the Viewer Describe a Probabilistic Future? Journal of Scientific Exploration, 35(3), 542–569. https://doi.org/10.31275/20211923

- Smith, C. C., Laham, D., & Moddel, J. (2014). Stock market prediction using associative remote viewing by inexperienced remote viewers. Journal of Scientific Exploration, 28(1), 7–16.

If you’d like to explore how remote viewing could boost your performance then arrange a call now.

“Walter von Lucadou’s Model of Pragmatic Information (MPI) is a theoretical framework developed to explain phenomena in parapsychology, particularly non-local correlations observed in experiments (e.g., psi phenomena), without violating physical laws. The model posits that these correlations emerge from systems operating under a holistic, non-causal order, where information is not transmitted in the conventional sense but arises contextually through organizational patterns. Drawing on concepts from systems theory, quantum theory (especially the idea of entanglement), and chaos theory, MPI suggests that “pragmatic information” is meaningful only within the context of a system’s structure and constraints. This information cannot be used for signaling or manipulation, thereby preserving physical causality while allowing for the appearance of psi effects in certain experimental conditions.” – ChatGPT ↩︎